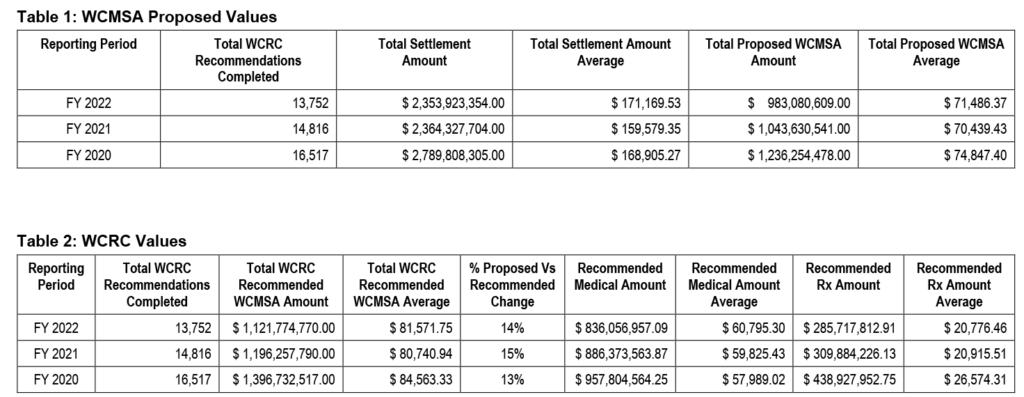

Medicare Set-Aside Statistics 2020-2022 Continue to Show Increase in Submitted MSA Amounts

by B. Smith

This week, the Centers for Medicare & Medicaid Services (CMS) released the 2020-2022 fiscal year statistics for Workers’ Compensation Medicare Set-Asides (WCMSAs) that have been submitted to CMS for review. The statistics shed additional light on why the CMS review process is not always the first choice of settling parties.

Table 1 below demonstrates that submissions to CMS have decreased since 2020 from 16,517 to 13,752 (over 16%). This may be due, in part, to the number and nature of CMS development requests which sometimes result in delayed or aborted settlements. The decline in submissions may also be related to the allocation philosophy CMS uses when evaluating WCMSAs. On February 17, 2022, CMS held a webinar and explained that even when a claimant has not been treated for several years, CMS must take a “worst case scenario” position when allocating for future medical. This approach results in counter-higher responses from CMS, which may further push parties away from the voluntary submission process. Table 2 below indicates that the WCRC, on average, has increased the proposed WCMSA amount by 13% in 2020, by 15% in 2021, and by 14% in 2022. This percentage is on top of allocations that are submitted based on CMS’ methodology, which can also be inflated.

Source: CMS WCMSA Fiscal Year Report (2020-2022) – October 2022

It is important to note that addition of Section 4.3 to the WCMSA Reference Guide did not in any way change the law with respect to WCMSA submissions. Submission of a WCMSA to CMS remains a voluntary process. CMS issued an updated Reference Guide 3.6 in March 2022 that clarified the voluntary nature of submissions and specifically stated that CMS will not deny medical payments if the MSA is sufficiently funded, and it can be demonstrated that the funds were used and exhausted appropriately.[1] This is also in line with the Medicare Secondary Payer Act and the Code of Federal Regulations accompanying the Act. It is also important to note that submission of a WCMSA to CMS does not prevent CMS from denying payment in the future or causing the parties to argue with CMS that payment should be made. CMS may deny payment for Medicare-covered, injury-related, medical expenses by mistake or when the funds are not properly managed.

Whether you submit a WCMSA for CMS review, choose a non-submit program, or use a hybrid approach, building a Medicare compliance program is one of the first steps to determining what is right for you and your organization.

For questions regarding this blog or to discuss any of your Medicare compliance questions, please contact the IMPAXX Settlement Consultant Group at [email protected].

[1] CMS may at its sole discretion deny payment for medical services related to the WC injuries or illness, requiring attestation of appropriate exhaustion equal to the total settlement as defined in Section 10.5.3 of this reference guide, less procurement costs and paid conditional payments, before CMS will resume primary payment obligation for settled injuries or illnesses, unless it is shown, at the time of exhaustion of the MSA funds, that both the initial funding of the MSA was sufficient, and utilization of MSA funds was appropriate. This will result in the claimant needing to demonstrate complete exhaustion of the net settlement amount, rather than a CMS-approved WCMSA amount. WCMSA Reference Guide 3.6: Section 4.3.